By Richard Granat

One of the obstacles to the development of innovative software solutions that automate part of the legal service delivery process resulting in lower, more affordable legal fees is the absence of capital. Traditional methods of legal service delivery based on hourly billing rates out of reach for low and moderate income clients. Capital investment is required to create innovative web-based software solutions that can enable low and moderate income clients to either solve legal problems on their own as pro-se litigants, or to enable law firms to offer legal solutions at a more affordable price point.

The major obstacle to making more capital available to law firms, is the prohibition on investment in law firms by nonlawyers enshrined in the ABA’s Model Rules of Professional Responsibility and replicated in the state rules of professional responsibility that regulate lawyers in their state. [ See Rule 5.4 – Professional Independence of a Lawyer ].

There has been little innovation within solo and smaller law firms to develop client-centered, web-based applications that provide a low cost solution to low and moderate income clients. Instead innovation is centered in the vendor community that provides tools to law firms, usually as a SaaS service for a monthly subscription fee. A good example is our own DirectLaw virtual law firm platform that provides a client-centered document automation application, and other tools that enables a law firm to unbundled legal services for a fixed fee to clients online. While the value of innovation outside of the law firm, within the vendor sector of the legal industry, is not to be minimized, it is the lawyer within the law firm that has the most nuanced view about what their clients need and want. The lawyer within the law firm also has the primary interest in figuring out how to develop and manage the delivery of legal services so that for certain kinds of legal problems a scalable, volume-based business model can be implemented.

Innovation requires capital. It is capital intensive to develop software applications and new delivery systems for legal services. Solos and small law firms that serve individuals and families do not have access to capital. Whatever innovation is taking place in the delivery of legal services is happening outside of the legal profession in organizations like LegalZoom financed by venture capital, or the within legal aid programs funded in part by the Technology grant program within the Legal Services Program, or outside of the United States. [See also, blog post from Lexicata – How Law Firms Can be More Like LegalZoom ].

There has been much controversial discussion with the legal profession on modifying the ownership rules that apply to law firms, with little result. For example, the American Bar Association created last year a Commission on the Future of Legal Services to address the access to justice problem, under the under the leadership of then ABA-President William C. Hubbard. The Commission convened a National Summit on Innovation in Legal Services, in May 2015 where private investment in law firms as a prerequisite to innovation was on the agenda. But I have yet to see any progress on this issue within the American Bar Association. Unlike other countries, private investment in law firms as a way to develop new ways of serving a latent market for legal services is dead on arrival when it reaches the ABA’s House of Delegates, although 80% of the U.S. population can’t afford the cost of legal services and is unserved by the legal profession.

The evidence we have seen in the United Kingdom, where the legal profession has moved towards de-regulation, and where capital can flow freely into law firms, suggests that the United States will remain a laggard in innovation in the delivery of legal services until this problem can be fixed. In the UK, LegalZoom is taking advantage of this de-regulation by becoming an ABS [ Alternative Business Structure ]. As a private company, operating in the UK, LegalZoom can offer legal services directly to the public. LegalZoom plans to use this opportunity to develop and experiment with new end-to-end legal services for consumers with the idea that in the far distant future these innovations can be imported into the U.S. legal market.

The bottom line is that you can’t really innovate without access to capital – it is the fuel of innovation. For solo and small law firms that serve people, rather than large corporations, capital is not available for innovation unless the lawyer or law firm has generated capital from their practice and makes a conscious decision to invest in software automation and web-based solutions.

An example of a law firm that has accumulated capital (because of litigation against the mortgage servicing companies and the banks in the robo-signing scandal during the U.S foreclosure crisis) is IceLegal, P.A., a small law firm based in Florida. IceLegal, under the leadership of Thomas Ice, is launching its own access to justice initiative. The firm has also created its own LegalYou video channel for educating pro-se litigants. This is a project of the law firm (not of a private company), and will provide low cost legal solutions to Florida residents. If LegalYou is a success it will serve a new latent market ignored by most of Florida’s law firms. LegalYou is the exception rather than the rule.

One would think that Internet-savvy, recent law school graduates would be motivated to serve a latent market for legal services by developing innovative solutions, but handicapped by large student loans they are forced into career roles that provide sufficient cash flow to amortize those loans. Risk-taking is not an option for them.

A Proposal: Safe Harbor for Law Firms Serving Low and Moderate Income Clients

To increase the flow of capital to law solos and small law firms who wish to serve only low and moderate income clients with automated legal solutions, I propose that:

- The American Bar Association amend Rule 5.4 to permit private investment in just those law firms that serve low and moderate income clients exclusively.

- Personal injury and other contingent fee practices would be excluded from this exception as capital is self-generating for successful firms in these practice areas.

- To comfort those who are concerned that the independence of the lawyer is compromised by this proposal, the law firm must remain at least a 51% owner of the law firm. Private investors can be minority shareholders only.

- It is relatively easy to create an income generation screen to capture just low and moderate income clients for the law firm, and exclude those of higher income. The data from this intake process can be archived and audited to comply with the exception to the rule.

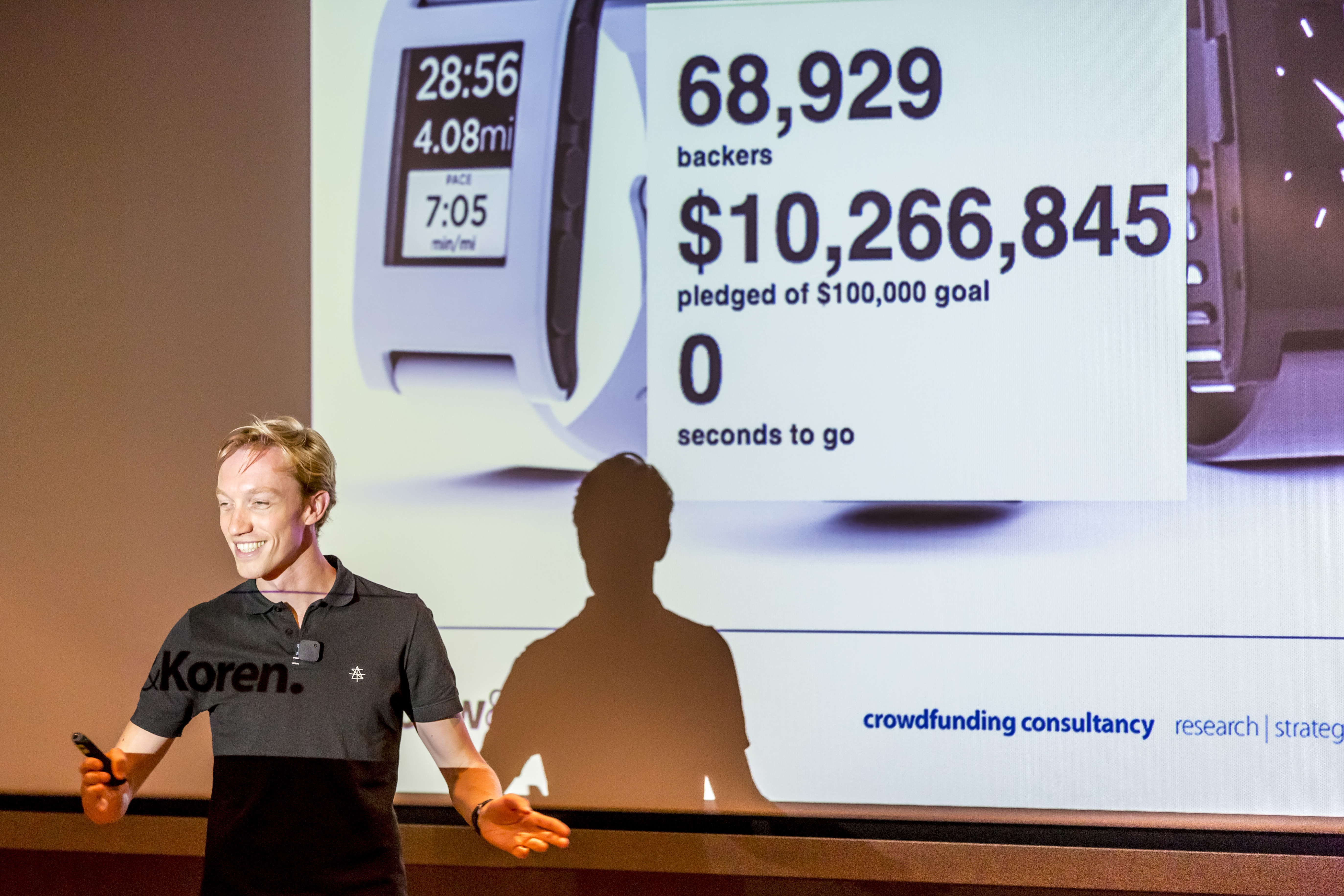

Creating this exception opens up the opportunity for smaller law firms to take advantage of crowd-funding opportunities, the angel investor community, and the new SEC rules that permit crowd-funding investment. Further, the rich relatives and friends (if they exist) of a young lawyer could fund the new lawyer’s law firm, and get a return on investment, without the lawyer risking disbarment because of violation of the 5.4.

An argument can also be made that enabling law firms that serve primarily corporate entities can create capital on their own without additional incentives and should not be able to take advantage of this safe harbor. Most large law firms represent corporate entities (banks, insurance companies, health care organizations, drug companies, manufacturers, financial organizations) whose legal positions are opposed to many consumer interests. These firms should have to use their own capital to become more efficient so as not to tip the balances against the consumer even more than it is.

One would think that this modest proposal to enable innovation designed to increase access to the legal system for clients who can’t afford the high cost of legal fees would be an idea that that American Bar Association and state bar associations might entertain or even discuss.

However, given that the structure of regulation of the legal profession is controlled by the legal profession, this idea will probably be dead on arrival.

Article via eLawyering Blog, 4 December 2015

Photo: the shadow of justice via Jack [Creative Commons Attribution-NonCommercial-NoDerivs]